A Detailed Guide To Epf What Is Epf Eligibility Benefits Etc Workex Blog

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

No Penalty On Employers For Delay In Provident Fund Contributions Decides Epfo The Financial Express

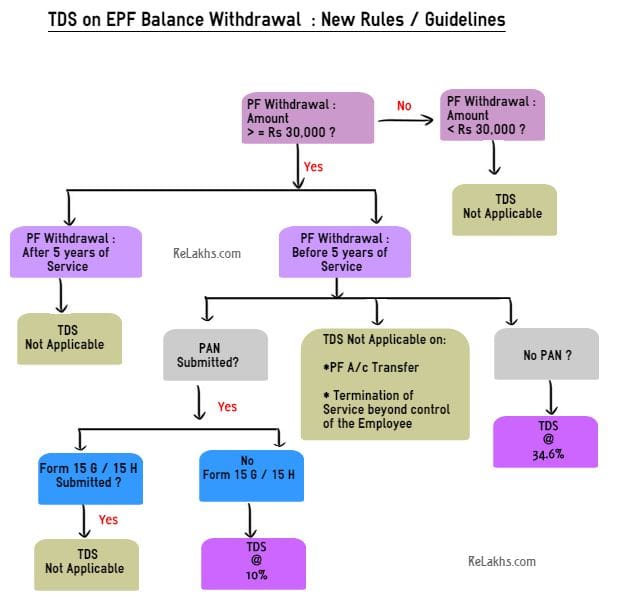

Tax On Epf Withdrawal Rule Flow Chart Personal Finance Rules

Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc

If Employer And Employee Agree There S No Bar In Epf Enrolment Mint

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Is Your Employer Depositing Pf Money To Epfo Or Trust If Not Then What To Do

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

What Is Epf Deduction Percentage Quora

Bombay Hc Says Refund By The Builder To Buyers Not Liable To Tds Under Rera Business Advisor Business Updates Builder

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

A Complete Guide On Process For Epf Withdrawal Online Claim Ebizfiling

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

Income Tax Benefits On Epf Contribution Existing V New Tax Regime

Epf Withdrawals New Rules Provisions Related To Tds

How To Calculate Provident Fund Online Calculator Government Employment

Interest On Epf Contribution Above Rs 2 5 Lakh To Be Taxable What It Means For You Businesstoday

Employer Must Pay Damages For Delay In Payment Of Epf Contribution Rules Sc Mint